A Strategic Guide to Investing in Mixed-Use Developments in the UAE

Mixed developments bring together residential, commercial, and lifestyle spaces in a single environment. And they're not just for tenants who value walkability, they’ve also become a favorite among investors who want diversified income and long-term growth potential.

For investors, these developments present unique opportunities, combining diverse revenue streams with the potential for long-term growth.

In this guide, we'll explore:

-

The defining characteristics of mixed-use developments

-

Their role in urban revitalization

-

The current landscape of the UAE market

-

Strategic investment considerations

-

Legal and regulatory insights for foreign investors

-

Case studies of successful projects

-

Emerging trends shaping the future of Dubai's real estate

Quick Facts About Mixed-Use Developments in the UAE

|

Aspect |

Details |

|

Definition |

Projects that combine residential, commercial, and recreational spaces |

|

Typical Components |

Apartments, office spaces, retail outlets, entertainment, wellness zones |

|

Why They Matter |

Offer walkability, reduce congestion, diversify investment returns |

|

Where in UAE? |

Dubai Marina, Business Bay, Wasl1, Dubai Creek Harbour, Yas Bay, and more |

|

Investor Advantage |

Multi-stream income + long-term tenant retention + strong resale demand |

|

Trend Forecast (2025–2030) |

Expected expansion in Tier 2 areas and demand for affordable luxury units |

Definition and Characteristics of Mixed-Use Developments

At their core, mixed-use developments are self-contained neighborhoods that merge key elements of daily life into one integrated environment.

Instead of separating residential, business, and leisure zones across a city, these projects bring everything together in a single location, reducing commute times, increasing convenience, and encouraging organic interaction among people and businesses.

▸ What Makes a Development “Mixed-Use”?

A development typically qualifies as “mixed-use” when it includes at least two of the following:

-

Residential spaces (apartments, villas, co-living)

-

Commercial offices or coworking hubs

-

Retail outlets (grocery stores, cafes, malls)

-

Recreational areas (gyms, cinemas, parks, walking trails)

-

Cultural or public institutions (museums, schools, clinics)

There are two main formats:

-

Vertical mixed-use: Everything is stacked in one building or complex. Think residential floors above retail shops and restaurants.

-

Horizontal mixed-use: Components are spread across several buildings but within the same master-planned area, like an interconnected mini-town.

▸ Key Characteristics of High-Performing Mixed-Use Projects

|

Feature |

Why It Matters |

|

Walkability |

Encourages foot traffic, improves health, and reduces car reliance |

|

24/7 activity cycle |

Keeps the area active and secure throughout the day and night |

|

Diverse income streams |

Generates revenue from residential rents, office leases, and retail space |

|

Efficient infrastructure |

Shared utilities and maintenance lower operating costs and simplify management |

|

Community-first design |

Includes public areas, parks, and cultural nodes that boost social interaction |

▸ Why Are Mixed-Use Projects Trending?

They reflect how people actually live—blending work, life, and leisure in fluid, convenient ways.

-

They help reduce traffic congestion and urban sprawl by minimizing the need to drive.

-

They’re seen as a more resilient investment because of their ability to perform across different market conditions.

According to ULI

(Urban Land Institute), neighborhoods with mixed-use zoning see property values rise 14%–18% faster than traditional single-use zones. That means higher resale potential for homeowners and stronger returns for real estate investors.

▸ Importance in Urban Revitalization

Cities change. Neighborhoods thrive, then decline, then transform. And when planners want to bring an area back to life, they’re not reaching for old solutions like standalone malls or isolated apartment towers anymore. They’re building mixed-use environments, and for good reason.

Mixed-use developments have emerged as powerful tools for reviving underperforming urban districts. Rather than fixing just one problem (e.g., housing shortages or traffic), they tackle several at once by combining smart land use with economic stimulus and social vibrancy.

How Mixed-Use Projects Revitalize Urban Areas:

-

Turn neglected zones into magnets for activity

→ Empty lots and abandoned buildings are replaced by thriving spaces filled with restaurants, homes, and small businesses. -

Reintroduce foot traffic and “eyes on the street”

→ This naturally improves public safety and supports local shops. -

Leverage public-private collaboration

→ Governments support infrastructure, while developers bring in services and housing. -

Create people-centric public spaces

→ Parks, walkways, and plazas encourage community events, leisure, and everyday use. -

Attract long-term investment

→ Areas with mixed-use design see better tenant retention and rising property values.

▸ Real-World Example: Al Seef, Dubai Creek

A once-overlooked stretch along the Dubai Creek was reimagined into a cultural and commercial hotspot. Al Seef is now a mix of heritage-style buildings, boutique hotels, and waterfront cafes.

By integrating hospitality, retail, and walkable public areas, it transformed into a go-to destination for both residents and tourists.

Data point: A 2024 study published in the International Journal of Social Research and Architecture found that mixed-use zones increase land efficiency by 25% and improve average public space usage by 40% compared to mono-use districts.

▸ Why Investors Should Care

Property in revitalized districts often enters the market at lower prices and appreciates faster.

-

These zones attract stable, long-term renter, from young professionals to small business owners.

-

The integrated environment reduces vacancy risk across asset types (retail, office, residential).

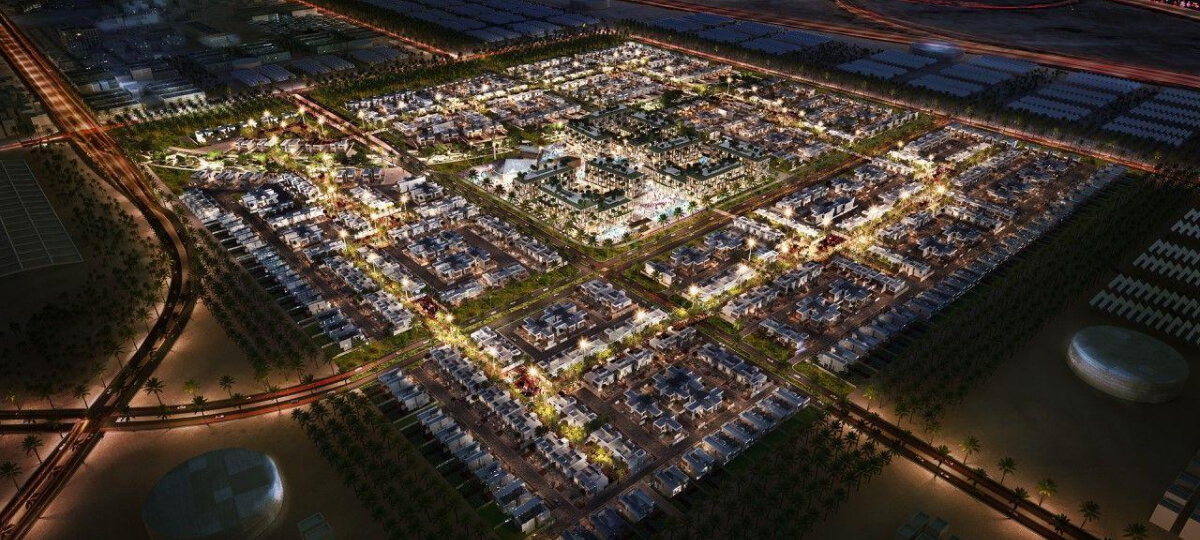

Overview of the UAE Market

Over the last decade, major cities in the UAE, like Dubai and Abu Dhabi have embraced master-planned, multi-use districts as the default urban model.

And this shift isn’t driven by aesthetics or marketing, it’s about scalability, sustainability, and high-yield investment opportunities.

Why the UAE Prioritizes Mixed-Use Design:

-

Limited space, high population growth

With rapid urbanization and rising demand for housing and services, stacking functions in one zone is more efficient. -

High expectations for convenience and lifestyle

Residents, many of whom are expats, want access to everything without long commutes. -

Sustainability and smart-city goals

Integrated developments align with UAE’s green building codes and smart infrastructure initiatives. -

Investor-friendly real estate laws

Freehold zones and visa-linked property options attract foreign buyers to mixed-use projects.

▸ Key Mixed-Use Districts in the UAE:

|

Development |

City |

What’s Included |

|

Business Bay |

Dubai |

Office towers, luxury apartments, hotels, retail, canal walkways |

|

Dubai Creek Harbour |

Dubai |

Waterfront residences, public parks, Dubai Square mall |

|

Yas Bay |

Abu Dhabi |

Residential units, entertainment district, Etihad Arena |

|

Wasl1 |

Dubai |

Mid-rise apartments, office spaces, direct metro connectivity |

|

Reem Island |

Abu Dhabi |

High-rises, schools, healthcare, and retail malls |

▸ Market Snapshot (2025):

Up To 11%

Residential demand in mixed-use districts (source: Khaleej Times).

-

Rental yields in these zones outperform single-use areas by 0.8–1.5% on average (Gulf News).

-

Occupancy rates in Business Bay, one of Dubai’s most prominent mixed-use areas, exceed 90%.

▸ What’s Driving Buyer Interest?

Expats want live-work-play ecosystems.

-

Young professionals prioritize walkability and access to gyms, cafes, and coworking spaces.

-

Investors are shifting toward diversified assets that offer multi-stream income (residential + retail).

Pro tip: Projects near metro stations or large malls tend to hold higher resale value.

Proximity to transport = higher rental appeal.

The Strategic Importance of Investing in Mixed-Use Developments

Mixed-use developments are quietly reshaping how investors build long-term real estate portfolios. In Dubai, for instance, these integrated projects offer stability, diversification, and consistent demand across economic cycles.

Unlike single-use properties, mixed-use assets can remain resilient even during downturns. If residential leasing slows, commercial or retail components may continue performing, and vice versa.

▸ Why Investors Are Moving Toward Mixed-Use Projects

-

Diversified Income Streams

- One building or community can generate revenue from:

- Residential rents

- Commercial leases

- Retail turnover-based contracts

- Short-term holiday rentals (where allowed)

-

Higher Occupancy and Retention Rates

Tenants and owners stay longer because of convenience and access to services. Vacancy rates tend to be lower across all components.

-

Increased Asset Value Over Time

Properties in mixed-use areas often see stronger capital appreciation, particularly when located near transit or business zones.

-

Appeal to a Broader Tenant Base

These developments attract individuals, families, startups, corporates, and retailers, all within the same footprint.

Financial Advantages for Dubai Real Estate Investors

According to a recent analysis by The National News and CBRE UAE, mixed-use developments in Dubai’s core zones recorded:

|

Metric |

Performance (2024–2025) |

|

Average Rental Yield |

6.5%–8.1% (vs. 5.4% city average) |

|

Capital Appreciation (YoY) |

7% in mixed-use vs. 4.2% in single-use residential zones |

|

Tenant Retention (1-year) |

85%+ in Business Bay, Dubai Marina, Wasl1 |

▸ Risk Mitigation Built Into the Model

Commercial and residential balance protects cash flow.

-

Public infrastructure (metro, malls, parks) in these zones increases demand.

-

Mixed-use zoning laws in Dubai often come with incentives for developers and fewer restrictions for foreign buyers.

▸ Benefits for Property Investors

Investors today are no longer just buying square footage, they’re buying convenience, tenant retention, future-proof layouts, and reliable returns. Mixed-use developments check all of those boxes in ways that single-purpose buildings usually can’t.

What Makes Mixed-Use Attractive for Property Investors?

Multiple Revenue Channels

Residential units bring stable, long-term rental income.

Commercial leases typically offer higher returns per square foot.

Retail tenants often agree to revenue-sharing models (percentage rent), creating an upside as footfall increases.

Short-stay units (in licensed buildings) can also be monetized via platforms like Airbnb or direct corporate leasing.

Built-In Demand

Tenants are drawn to the convenience—gyms, offices, cafes, and schools within walking distance.

Businesses prefer locations with guaranteed residential footfall nearby.

Families appreciate integrated spaces where they don’t need to drive to access day-to-day needs.

Resilience During Market Volatility

During downturns, one property type might dip while others hold steady.

The diversified use acts like a buffer, reducing the risk of income drying up entirely.

Higher Occupancy Rates

A study by Knight Frank in 2024 showed that occupancy rates in Dubai’s mixed-use zones remained above 90%, even during rental corrections.

Projects like City Walk and Dubai Hills consistently report low vacancy due to high walkability and lifestyle access.

Stronger Long-Term Appreciation

Mixed-use zones are often part of larger masterplans (e.g. Dubai Creek Harbour, Wasl1), which include ongoing infrastructure improvements.

That means capital values rise not just with market trends, but as the district matures.

Role in Sustainable Urban Planning

Now, sustainability is at the core of city designs to help people live more efficiently, waste less time and energy, and build communities that last. Mixed-use developments hit these targets by default.

These spaces are designed to reduce the need for cars, limit urban sprawl, and maximize land use, all key goals in modern urban planning strategies across the UAE.

How Mixed-Use Projects Align with Sustainable Development:

-

Walkable Design

Mixed-use neighborhoods allow people to live, work, shop, and socialize without driving. This reduces: -

Carbon emissions

-

Noise pollution

-

Urban traffic congestion

-

Higher Land Efficiency

Vertical zoning makes better use of expensive land, especially in urban cores like Business Bay or Downtown Dubai.

-

Shared Infrastructure

Utilities like cooling systems, energy grids, water recycling, and waste management are often centralized. This lowers: -

Operational costs

-

Per capita resource consumption

-

Transit-Oriented Development (TOD)

Many projects are built around metro stations or key bus hubs, reducing dependency on private vehicles and promoting public transport use.

-

Green Building Compliance

Many mixed-use developments in Dubai and Abu Dhabi are required to meet standards like: -

Estidama (Abu Dhabi’s sustainability rating system)

Examples from the UAE:

-

Dubai Creek Harbour

Masterplanned with climate resilience, solar lighting, and car-free walkways in key zones. The area includes over 700,000 square meters of green open spaces. -

Masdar City (Abu Dhabi)

Though more experimental, it reflects the extreme end of sustainability, with mixed-use planning as a core feature, combining residential housing, clean tech firms, and leisure.

Investor Advantage:

-

Sustainability certifications improve resale value.

-

Energy-efficient buildings reduce service charges—making units more appealing to tenants.

-

Properties in walkable, low-emission areas are favored by international buyers and ESG-conscious funds.

▸ Impact on Community Development

Mixed-use developments change fully how people connect, socialize, and live their daily lives. By removing the barriers between where people live, work, and gather, these projects create a more natural rhythm for human interaction.

And that matters, because strong communities aren’t built by accident, they’re designed into the environment.

How Mixed-Use Environments Foster Community:

-

Built-In Social Interaction

When people run into neighbors at the local cafe, walk their dogs near shared green space, or attend events in the plaza downstairs, they’re more likely to form real connections. -

Inclusion Across Income Levels

Developments that blend mid-range apartments with retail spaces and co-working hubs create zones where professionals, families, and entrepreneurs share the same ecosystem. -

Safe, Active Public Spaces

Pedestrian-only walkways, seating areas, and small parks draw people out of their units and into shared environments, boosting foot traffic and natural surveillance (which improves safety). -

Live-Work Balance

With shorter commutes, or none at all,residents have more time for leisure, relationships, and civic engagement. -

Shared Amenities = Shared Identity

From gyms to playgrounds to rooftop lounges, when spaces are communal, they foster a stronger sense of belonging.

▸ Case Snapshot: Dubai Hills Estate

Though technically suburban, Dubai Hills functions as a self-contained district. Residents live near schools, parks, a mega-mall, and even a golf course.

Because of its integrated design, it attracts families, young professionals, and even retirees, all of whom use shared spaces daily. Over time, this shapes a more cohesive local culture.

What This Means for Investors:

-

Properties in well-designed community-oriented developments tend to have lower churn.

-

Long-term renters and buyers often seek emotional connection to their neighborhood, not just functional housing.

-

Word-of-mouth and organic demand are stronger when a place “feels like home.”

And when a development becomes more than just a set of buildings, when it becomes a neighborhood, it builds brand value that outlasts short-term market shifts.

Real Estate Investment Strategies for Dubai

The Dubai real estate market is known for high growth, tax efficiency, and a consistent stream of international buyers. But when it comes to mixed-use investments you should understand micro-markets, regulations, and future demand.

Let’s break down what works in today’s climate and how to think like a long-term investor in one of the region’s most dynamic real estate ecosystems.

✓ Identifying the Best Property Investment in Dubai

Not all mixed-use projects are equal. Location, connectivity, tenant demographics, and future infrastructure plans all matter. Here’s how to identify properties that outperform:

Focus Areas That Deliver:

-

Business Bay

Central, with a mix of commercial towers and residential high-rises. Proximity to Downtown Dubai and the canal makes it appealing to professionals and tourists. -

Dubai Creek Harbour

Designed for the long haul. Offers views of the future tallest tower, walkable zones, and a mix of waterfront apartments and cultural spaces. -

Jumeirah Village Circle (JVC)

More affordable entry point with mid-rise mixed-use buildings, good for rental yield seekers. -

Wasl1 and Al Kifaf

Metro-connected zones near Zabeel Park, blending lifestyle and city-center convenience. Ideal for end-users and professionals.

Property Types with Strong ROI Potential:

-

1-bedroom units with balcony + community view

Popular with singles and couples; low vacancy rate. -

Retail spaces under 1,000 sq ft

High demand from cafes, salons, boutique gyms in walkable zones. -

Serviced apartments in branded residences

Often used for corporate short-stays, yielding higher nightly rates.

Factors Influencing Investment Returns

When choosing where to buy in a mixed-use development, consider the following:

|

Factor |

Why It Matters |

|

Metro Access |

Increases rental demand and resale value |

|

Retail Density |

More foot traffic = higher lease value for retail tenants |

|

Service Charges |

Affects net yield—low shared costs are better for profitability |

|

Developer Reputation |

Impacts delivery quality, resale confidence, and rental demand |

|

Masterplan Completion |

Early entry may offer lower prices, but resale depends on delivery |

Projects that sit within 400m of a metro station in Dubai average 9–14% higher rental yields.

Smart City Initiatives and Their Influence on Investments

Dubai has publicly committed to becoming one of the world’s leading smart cities. This has direct implications for real estate investors, especially in mixed-use zones, where infrastructure is built to support:

-

Smart energy systems (district cooling, solar integration)

-

Digital infrastructure (fiber-optic connectivity, smart sensors)

-

Mobility tech (EV charging stations, autonomous transport integration)

-

AI-powered building management (predictive maintenance, usage analytics)

Developments built under the Smart Dubai 2030 framework are already seeing faster occupancy rates and better media coverage, translating into higher buyer interest and, eventually, resale value.

Navigating the UAE Property Market

Dubai has earned its reputation as one of the world’s most accessible real estate markets for foreign investors. There’s no property tax, no capital gains tax, and no restrictions on foreigners buying freehold property in designated areas.

But before diving in, understanding the legal framework, buyer eligibility, and pricing trends is essential, especially when dealing with multi-use developments that involve both residential and commercial assets.

▸ Buying Property in Dubai as a Foreigner

Yes, you can absolutely buy property in Dubai as a non-resident. In fact, foreign ownership is encouraged in over 60 designated freehold zones, including popular districts like:

-

Dubai Marina

-

Business Bay

-

Downtown Dubai

-

Jumeirah Village Circle (JVC)

-

Dubai Hills Estate

-

Dubai Creek Harbour

Key Facts:

-

You don’t need a UAE residency visa to buy freehold property.

-

Minimum age to buy is 21.

-

No requirement to live in Dubai before or after purchase.

-

Foreigners can own 100% of property in freehold areas—both residential and commercial units.

Pro tip: Buying property worth AED 2 million or more may make you eligible for a 10-year Golden Visa under current UAE regulations.

Legal Considerations and Regulations

Before you purchase, here’s what you need to know legally:

-

Title Deed: Issued by the Dubai Land Department (DLD). Ensure your name appears on the title deed for proof of ownership.

-

Oqood Registration: If you’re buying off-plan, the developer must register your unit with the DLD through the Oqood system.

-

No Income Tax: Rental income is tax-free in the UAE. However, your home country may have tax obligations.

-

Service Charges: Annual maintenance fees apply to all properties and vary by project. These should be factored into your ROI calculations.

Read how you can maximize your ROI and build long-term wealth in Dubai’s real estate market in this blog.

-

Escrow Protection: All off-plan payments must be deposited into an RERA-approved escrow account, protecting buyers if the developer fails to deliver.

If you’re buying a unit in a mixed-use building, confirm:

-

Zoning (residential, retail, commercial) to ensure leasing flexibility

-

Licensing (for short-term lets or retail operations)

-

Shared costs and management agreements for mixed-function buildings

Average Real Estate Price Trends in Dubai

Property prices in Dubai have risen consistently since late 2021, with especially strong growth in prime mixed-use areas.

|

Zone |

Average Price/Sq Ft (Q1 2025) |

YoY Price Growth |

|

Dubai Creek Harbour |

AED 1,600 |

11.2% |

|

Business Bay |

AED 1,850 |

9.4% |

|

Dubai Hills Estate |

AED 1,700 |

8.1% |

|

JVC |

AED 1,200 |

6.7% |

|

Wasl1 |

AED 1,950 |

7.5% |

In mixed-use areas with good connectivity, rental yields still average 6.5–8.1%, which remains above global benchmarks for urban residential real estate.

Case Studies of Successful Mixed-Use Developments in the UAE

Dubai and Abu Dhabi have become global testing grounds for large-scale mixed-use projects.

From high-rise residential towers built over luxury retail strips to master-planned mini-cities with their own transport links, the results are clear: these developments attract both end-users and investors, and they deliver.

What are the top real estate investment destinations in Dubai and what makes them stand out? Find out more here.

Notable Projects and Their Performance

➝ Dubai Creek Harbour

-

Developer: Emaar

-

Components: Residences, schools, metro links (future), parks, and what will be the world’s next tallest tower

-

Performance:

-

Properties in the first phases appreciated by 17–21% between 2022–2024.

-

Studio apartments now yield 6.9% average annual rental returns.

-

Investor Takeaway: Early buyers benefited from masterplan hype and escalating demand. Strong secondary market liquidity now exists due to infrastructure rollouts.

➝ City Walk Dubai

-

Developer: Meraas

-

Components: Residential buildings, cafes, retail boulevards, luxury fashion, medical clinics, and entertainment venues

- Performance:

-

1-bed units: AED 2.3M average, with rental yields up to 7.5%

-

Retail tenants include both global brands and boutique cafes, driving footfall

-

-

Investor Takeaway: The walkability and outdoor layout appeal to tourists and residents alike. Short-stay holiday rentals perform exceptionally well.

➝ Yas Bay (Abu Dhabi)

-

Developer: Miral

-

Components: Etihad Arena, waterfront promenade, residential buildings, hotels, retail

-

Performance:

-

Area rebounded post-COVID with strong tourism-linked demand.

-

Apartments priced lower than Dubai equivalents, with rental returns around 6.2%

-

Investor Takeaway: Lower entry price makes this zone attractive for investors diversifying outside Dubai.

Lessons Learned from Urban Revitalization Projects

Mixed-use success is never random. Across all three projects, a few patterns stand out:

-

Strong central planning wins

Developments tied to metro expansion, parks, and public spaces perform best over time. -

Retail mix matters

A blend of global chains + local stores increases foot traffic and makes the project feel authentic. -

Branded vs. non-branded matters less than layout

Branded residences attract attention, but it’s walkability and lifestyle density that keep demand strong. -

Mid-sized units are the best performers

1- and 2-bedroom apartments consistently achieve higher occupancy, especially in mixed-use zones.

Future Trends in Dubai Real Estate Investment

Dubai’s real estate market doesn’t stand still, and mixed-use developments are evolving alongside broader demographic shifts, policy changes, and lifestyle preferences.

Over the next 3–5 years, we’re likely to see these changes reshape the city’s investment landscape.

▸ Growth of Affordable Housing Solutions

Not every mixed-use development in Dubai will cater to luxury buyers, and that’s a good thing.

With rising demand from:

-

Remote workers relocating under new freelancer and digital nomad visas

-

Young professionals priced out of ultra-prime areas

-

Middle-income expat families seeking community-centric living

…developers are moving toward affordable mid-market units within larger masterplans.

Emerging areas with affordable mixed-use offerings:

-

Jumeirah Village Circle (JVC)

-

Dubai South

-

Arjan

-

Town Square by Nshama

These zones combine:

-

Mid-rise residential with ground-floor retail

-

Walkable plazas and basic lifestyle amenities

-

Access to arterial roads and metro expansions (where applicable)

Data point: In 2024, JVC had the highest volume of rental contracts among all freehold areas, largely due to affordability and new handovers.

▸ Shifts in Dubai Housing Market Dynamics

Expect to see a gradual but noticeable move away

From:

-

Oversized luxury villas as defaults

-

Isolated residential towers with no surrounding services

Toward:

-

Compact, amenity-rich apartments in lifestyle communities

-

Mixed-use layouts with everything from yoga studios to laundromats built in

Buyers are no longer just shopping for space, they want convenience, community, and functionality.

Developers responding to this shift are:

-

Downsizing unit sizes

-

Improving shared amenities

-

Prioritizing location over branding

▸ Emerging Opportunities for Investors

|

Trend |

Investor Insight |

|

Rise of mixed-use districts outside Downtown |

Entry prices are lower, rental demand remains strong |

|

Focus on infrastructure-linked zones |

Buy near new metro extensions, parks, and education hubs |

|

Preference for mid-size units |

1- and 2-bed units offer the best balance of liquidity and return |

|

Growing demand for co-living/co-working |

Hybrid-use spaces appealing to young expats and remote teams |

|

Masterplans with payment plans |

Off-plan launches in places like Dubai South often offer flexible terms |

Learn what’s next for Dubai’s property landscape with key trends and predictions here.

Why Mixed-Use Developments Deserve a Spot in Your Dubai Investment Strategy

If you’re looking to invest in Dubai real estate in a way that makes sense for both today’s economy and tomorrow’s demand, mixed-use developments offer a balanced, strategic entry point.

They aren’t trend pieces or marketing gimmicks, they’re well-engineered responses to how people actually want to live and work.

Here’s what we’ve learned:

-

Mixed-use projects combine residential, commercial, and retail components, creating walkable environments that reduce commute times and drive consistent activity.

-

They support urban revitalization, turning neglected zones into thriving communities.

-

In the UAE market, especially in Dubai, these developments are central to new masterplans, like Dubai Creek Harbour, Wasl1, and Business Bay—that blend infrastructure, lifestyle, and accessibility.

-

For investors, mixed-use buildings offer multiple revenue streams, high occupancy rates, and better risk insulation than traditional single-use assets.

-

They align naturally with sustainable planning, making them attractive to both ESG-focused buyers and long-term renters.

-

Community-driven design leads to better tenant retention, lower vacancy, and long-term appreciation.

Dubai’s property market is maturing. It’s moving beyond speculation into stability. And as regulations become more transparent and demand shifts toward walkable, livable, fully serviced zones, mixed-use assets are positioning themselves as some of the most reliable real estate investments on the table.

Whether you're buying to hold, to rent, or to build long-term value in a growing city, mixed-use developments in the UAE offer something that’s increasingly rare in global real estate: a high-functioning asset with built-in demand.

FAQs About Mixed-Use Developments in Dubai

1. Is buying property in a mixed-use development in Dubai a good investment?

Yes. Mixed-use developments typically offer diversified revenue streams (residential + commercial + retail), higher occupancy rates, and better tenant retention.

In prime areas like Business Bay and Dubai Creek Harbour, these properties often outperform single-use real estate in both rental yield and capital appreciation.

2. Can foreigners buy property in mixed-use buildings in Dubai?

Absolutely. Foreigners can buy freehold property in over 60 designated zones across Dubai, including mixed-use areas like Downtown, Dubai Marina, and JVC. Ownership is 100%, and purchases can include both residential and commercial units, depending on zoning regulations.

3. What are the risks of buying in a mixed-use development?

The main risks include:

-

Higher service charges due to shared infrastructure

-

Dependency on the commercial component's success (especially retail)

-

Noise or foot traffic concerns in some buildings

Due diligence on the developer, layout, and building management is key.

4. Are mixed-use properties more expensive than regular residential units?

Not necessarily. While high-profile mixed-use zones (like City Walk) may come at a premium, there are also affordable options in areas like JVC or Arjan.

What you pay depends more on location, developer reputation, and facilities than the mixed-use label alone.

5. Which areas in Dubai have the best mixed-use investment potential right now?

Top-performing and emerging areas include:

-

Dubai Creek Harbour – long-term growth with infrastructure still expanding

-

Business Bay – strong rental market, especially for short-term stays

-

Wasl1 – metro access, Zabeel Park views, and central location

-

Jumeirah Village Circle (JVC) – high rental yield at lower entry points

Contents

- Quick Facts About Mixed-Use Developments in the UAE

- Definition and Characteristics of Mixed-Use Developments

- Overview of the UAE Market

- The Strategic Importance of Investing in Mixed-Use Developments

- Financial Advantages for Dubai Real Estate Investors

- What Makes Mixed-Use Attractive for Property Investors?

- Role in Sustainable Urban Planning

- Real Estate Investment Strategies for Dubai

- Factors Influencing Investment Returns

- Smart City Initiatives and Their Influence on Investments

- Navigating the UAE Property Market

- Legal Considerations and Regulations

- Average Real Estate Price Trends in Dubai

- Case Studies of Successful Mixed-Use Developments in the UAE

- Future Trends in Dubai Real Estate Investment

- Why Mixed-Use Developments Deserve a Spot in Your Dubai Investment Strategy

- FAQs About Mixed-Use Developments in Dubai